Maybe you’ve pondered the best way to buy large expenses including a home renovate otherwise child’s college education? Lots of people have fun with property collateral mortgage to fund these types of can cost you rather than using up the deals.

For many who own a home, you could potentially be eligible for a property equity loan. This type of fund makes it possible to loans issues may not be in a position to buy comfortably together with your month-to-month income. But are indeed there people limits throughout these funds? Can there be anything you are unable to money with this particular money? Continue reading understand what a home guarantee mortgage try and you can what you are able put it to use getting.

What is actually Home Equity?

Home security ‘s the difference between brand new appraised property value your own family and exactly how far you will still owe on the mortgage and you will various other property liens. Such, say your residence appraises to own $2 hundred,one hundred thousand and you’ve got $120,100 remaining to spend in your top home loan. Your kept family equity might possibly be $80,100000. You need property guarantee mortgage to help you borrow on an effective percentage of the latest guarantee you have got of your house.

What is actually a home Collateral Financing?

Extent you may use utilizes your own guarantee and also the house’s market price. Make use of your house since the collateral with the financing, of course, if you really have an initial mortgage with the home, it’s subordinate to that particular first mortgage. For this reason domestic equity loans are entitled 2nd mortgages.

Your loan can get a-flat identity and you may interest, similar to the first mortgage. When you get a property guarantee mortgage, you get your finances in one single lump sum payment at the start and you will always rating a predetermined rate on what your acquire.

In comparison, a property collateral line of credit (HELOC) allows you to mark at risk out-of credit as you are interested, providing revolving the means to access cash getting a set draw period. The percentage will then be according to research by the amount of cash you moved or complex. Having a great HELOC, you will likely get a varying rate that increases otherwise down according to primary speed.

How come property Guarantee Financing Functions?

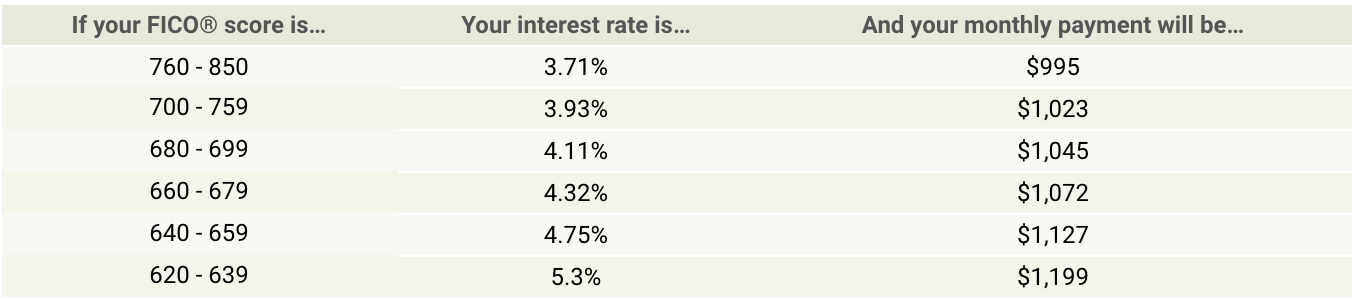

To be considered applicants to own a home collateral loan, really loan providers need an effective credit history. They’re going to think about the loan-to-value (LTV) proportion, which is the overall amount of mortgage loans or other liens on your house divided from the its appraised really worth. Which count will then be multiplied because of the 100 to-be indicated because a portion.

Such, state all of our $200K resident who had $120K remaining to expend on the family desired financing off $30K. This new LTV ratio will be: ($120K + $30K)/$200K = .75. Very, this new LTV will be 75%. The higher their LTV, the greater your own rate of interest is.

It’s important to remember that you will possibly not have the ability to acquire an entire property value your house, based the lender. You can examine with any possible financial prior to submitting the app observe just what restrictions he’s got in position.

Just like any home loan, there is certainly settlement costs regarding the a property equity mortgage, no matter if they truly are typically below an initial mortgage. You start to pay right back a home equity loan instantly and have to pay it off entirely towards the end of your financing name.

As to why Get a property Collateral Financing?

There are a few benefits to choosing property equity loan rather of some other variety of credit solution. A couple are usually down the page.

- Low interest. The costs discover to have a house collateral mortgage usually fall less than people you’ll be provided towards a personal bank loan or borrowing from the bank credit.

- Huge figures. Extremely home guarantee fund are to own nice sums of money a lot more than just a few hundred otherwise one or two thousand dollars. It can be tough to secure instance funds through-other form.

What are Home Collateral Loans Employed for?

Technically, you need a house equity mortgage to pay for one thing. Although not, many people utilize them for huge expenses. Check out really prominent purposes for home collateral funds.

- Remodeling a house. Payments in order to builders as well as for material sound right quickly.

- Medical expenses. A primary operations otherwise much time rehabilitation can cause high scientific expense.

- Education. Finance might help pay for personal supplementary schooling otherwise university.

Discover, not, some instances where a house collateral financing may not be the brand new sple? Performing a business. This really is a dangerous proposition. If you are using your residence guarantee to begin with a business, therefore the team goes wrong, you will probably find you are not able to make repayments on the loan. Because you put your house since the collateral, this might end up in a terrible-situation circumstances regarding dropping your home, along with your providers.

In addition, you may well not wanted a property collateral loan for many who try not to want to play with a good debt consolidation loans number of money immediately. With a home guarantee mortgage, obtain a lump sum and ought to repay it inside payments per month. Or even you need a giant contribution at the same time, you may be better off offered an effective HELOC or other loan that really needs that pay just into part of the financing you put.

Will you be searching for a house guarantee loan? We provide competitive costs for the users. Please remember and determine the WalletWorks web page for much more currency government information.

العب كورة اكبر موقع رياضي في الشرق الاوسط

العب كورة اكبر موقع رياضي في الشرق الاوسط