A house security mortgage was a famous way to borrow funds getting a house update opportunity, so you’re able to combine obligations, or spend unforeseen costs, instance. It could additionally be you are able to to make use of a house guarantee mortgage to get a special household.

Mainly because funds is actually recognized into the equity of your property, they’ve got straight down rates than many other borrowing from the bank selection. They’re able to even be obtained apparently rapidly. With regards to the lender, how long it takes to Applewood loans acquire a property guarantee mortgage will get be step 1-6 days.

Before applying to own property security loan, it is very important comprehend the impression you to settlement costs can have on the cost regarding borrowing from the bank. You will find some ways, yet not, as you are able to either clean out otherwise clean out that it expense.

Insurance policies

Certain types of insurance policies may be needed so you’re able to be eligible for a property collateral loan. They might become name insurance rates, home insurance, ton insurance rates, although some.

Local Fees

A city authorities will get determine an income tax on the house equity mortgage. Depending on in your geographical area, the new tax ount.

Label Search

A concept search may be required in order for nobody enjoys one claims otherwise liens on your own household. This will be required since the collateral you’ve got of your house is used due to the fact security. The term search payment might possibly be $100-$450.

Issues

An effective “point” is actually a charge as possible pay initial to reduce their interest rate. To find activities was optional, each part often decrease your rate of interest by a quarter off a percentage. For every point will cost 1% of the total amount of your loan.

How-to Lower your Home Collateral Financing Closing costs

Although many loan providers charges settlement costs on their household equity funds, there are many tips you can use to save cash on these types of charge. You are able to be able to eliminate specific or each of them.

Repay Latest Expense

With regards to your to have a house equity loan, lenders will have a look at your debts to ensure that you are not overextended. In the event that more than 43% of the terrible monthly earnings is employed to blow your own month-to-month debts, paying off a number of your debts before you apply can provide you a great deal more options for paying the settlement costs.

You may be because of the solution to financing the fresh closing costs, such as, by the addition of them to the primary. This can help you stop being required to assembled the new money upfront.

Examine Other Lenders’ Financing

Not all lenders have the same closing costs or the same rates. Therefore before applying to possess property guarantee mortgage, make sure you examine other lenders’ mortgage terms, interest rates, and you will settlement costs. This will help you get the best offer in order to spend less.

Be sure to Negotiate

Specific settlement costs is flexible. A loan provider ple, if you’re an extended-title customer. Make sure to ask about the fresh costs to find out if your own financial often believe waiving a few of them. You’ll never know if you don’t ask.

Simply Obtain What you need

When applying for a property equity loan, you may be tempted to obtain more you prefer. It is possible to acquire a great deal more to shop for something that you require, to take some more funds easily accessible, or for another reason. Credit over you want, although not, could cause highest closing costs.

The latest closing costs for domestic collateral financing are typically 2-5% of your own amount borrowed. The more you borrow, the higher this new fees might be.

Get a hold of a lender That offers Family Security Finance As opposed to Settlement costs

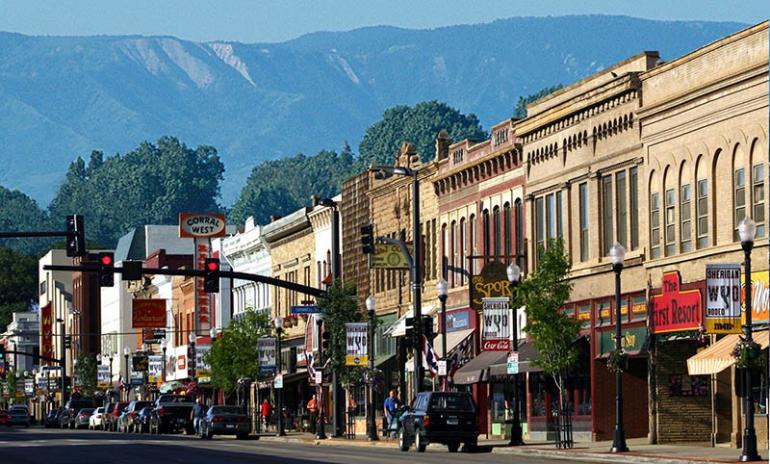

Probably the easiest way to save cash towards the home security mortgage closing costs will be to just like a lender that doesn’t costs one, eg Higher Colorado Credit Commitment. With respect to the amount youre borrowing from the bank, the discounts could well be tall.

Domestic Collateral Finance That have Deeper Colorado Credit Relationship

If you find yourself contemplating borrowing from the guarantee of your house, Better Tx Borrowing Union also provides a home equity loan that have good aggressive interest rate. Our home guarantee financing together with has no one settlement costs, which will surely help you save money.

The application process is straightforward and you may small. If you have any questions, you could potentially get in touch with one of our Loan Agency agencies of the phone or of the on the internet content having guidelines.

العب كورة اكبر موقع رياضي في الشرق الاوسط

العب كورة اكبر موقع رياضي في الشرق الاوسط